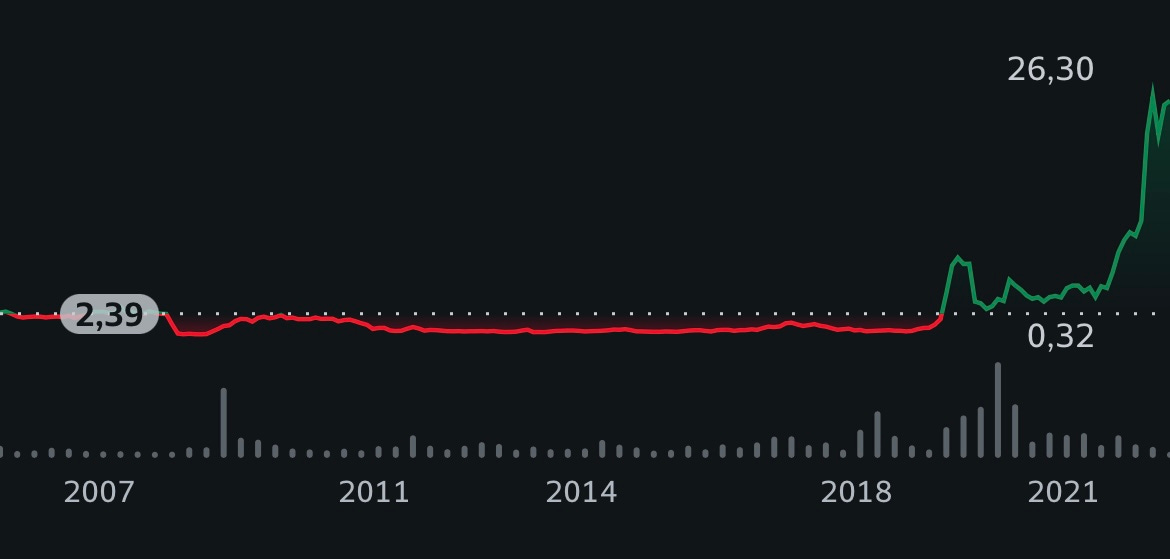

Reysas Tasimacilik ve Lojistik Tcrt AS (IST: RYSAS)

The deep undervalued Turkish warehouse clone of Mohnish Pabrai.

Disclaimer: This article is published for informational and educational purposes only. Anything written here is not financial advice and should not be seen as a buy or sell recommendation. Always do your own research or seek a financial advisor. The valuations discussed here are shown in dollars (unless indicated otherwise), these are converted from Lira’s at a price 18,88 TL to $1. Valuations, prices, information and ratios may have changed since the time of this writing. This writing is inspired by the interviews Mohnish gave about the company. All credits remain to Mohnish Pabrai.

Reysas Tasimacilik ve Lojistik Tcrt AS (IST: RYSAS - $374 million) is a Turkish company founded in 1989 in Ankara. Reysas is a logistics business that owns 61,4% of Reysas REIT, which in turn owns over 12 million sq. ft of Grade A warehouses in Turkey. The company is led by father and son, who operate in various other niches and hold stakes in multiple subsidiaries.

The company caught my interest by being a holding of Mohnish Pabrai, he talks a lot about the business in his lectures with students around the world and records it to share it on YouTube. Therefore, a lot of the article consists out of statements Mohnish made. I tried my very best to fact-check these statements and give you a brief overlook about the company and its valuation.

Accounting

Reysas has a huge amount of assets in Turkey and mainly all of them are warehouses. Their warehouses are 99% leased to blue chip companies like: Ikea, Amazon, Carrefour, Toyota and are currently being undervalued to their market cap.

While their market cap is around $374 million, the warehouse assets are valued around $1 billion dollars and counting. If we remove the current $135 million debt that the company has off of the asset value we would remain a value of around $825 million.This makes the current market cap a huge discount to their warehouse assets. A classic discount to net asset value play.

The debt to equity ratio of Reysas is: 1,59 which i believe is not high and very healthy for a capital intensive company.

Their total assets grew by 192.9% from 2019 till 2022. *consolidated

2019: 1.427.043.686 TL

2022: 4.179.404.602 TL

While their total liabilities only grew by 88.4% in the same period. *consolidated

2019: 1.363.664.830 TL

2022: 2.568.923.007 TL

Their current Free Cash Flow is around 30/40 million dollars which moves a lot because of the interest rates fluctuate.

Revenue

The revenue Reysas collects consists out of different subsidiaries where they hold stakes in:

as of 30.06.2022

Reysas Vehicle Inspection Stations Operating: 75,48% share of company in capital.

Reymar Tobacco Products Distribution and Marketing: 99% share of company in capital.

Reysas Railway Transportation: 100% share of company in capital.

Reysas Real Estate Investment Trust: 61,47% share of company in capital.

Reysas Tourism Investments and Trade: 61,47% share of company in capital.

Rey Hotel Tourism Management and Trade: 61,47% share of company in capital.

Subsidiaries represent the businesses which are controlled by Parent Company, directly or via other subsidiaries or affiliates, by holding more than 50% of the share.

Reysas owns 3 rail stations, they do not own the rail network which is all owned by the Turkish government and there not allowed to own the rail engine, so the train is run by the government but they own the rail car trough their deals with Toyota and other brands. They are the largest freight train company in Turkey.

They operate the largest truck fleet company in Turkey.

And they operate a small solar business where they place solar panels on their warehouses which they estimate to have a useful life of 30+ years.

The revenue of Reysas grew from 662.132.343 TL in 2019 to 1.303.034.627 TL last year. An increase of 96.8% and an average of 24.2% per year over the last 4 years.

Both the accounting and revenue show some interesting numbers. And although father and son are doing a great job managing the company, you can ask yourself if Reysas only is an “asset play”? Or that there is external value in the business that lays in the management team.

Management

Both father and son are highly praised by Mohnish because of their understanding of the businesses, their skin in the game and their amazingly capital allocation. They are not interested in anything where in a year or two they don’t get their money back. Therefore their reinvestment hurdles are 25 to 30% IRR.

According to Mohnish, which holds close contact with the family, the son is actually better than his father and together they form a yin-yang balance on running the company. What surprised me is that the son actually flew to Omaha last year to attend the Berkshire Hathaway meeting, which shows that he has somewhat of an interest in the stock market or his own shareholders. As of now the father and son don’t communicate that well to share holders, especially foreign investors. When Mohnish asked them about this they’ve stated that they want to leave it like it is right now and only focus on the things they are good at which is the business itself. This immediately explains why it’s so hard to find information about Reysas but I find it somewhat interesting since a lot of companies in Europe or the US are always screaming for attention and their not so good financial reports while father and son keep focussing on the business itself because that’s where their passion lays.

Also, there is about 41,1% of insider ownership in the company, which is mainly hold by the father and son. On top of that, Mohnish own 1/3 of the company since 2019.

Moat

The moat of Reysas mainly consist out of the fact that they are the biggest in their freight train, truck fleet, real estate and tourism business. They may have had some tailwinds but the moat is also based on the father and son which are phenomenal capital allocators and spawners. They’re spawning new businesses out of their core business and the new solar business is a great example of that. They know what they do, and only invest capital if they know they will get it back in a few years. These spawners help the business growing in value and keep increasing its intrinsic value.

Valuation

It’s somewhat hard to value every subsidiary of Reysas, therefore I’m only going to focussing on the warehouse business.

The warehouses in total, are about 12 million square feet (as of dec 2021). These are 99% leased and have lease contracts for 10 years. The estimated useful life of these assets is 10 to 50 years. In Turkey the value of one square feet to replacement value is around $80, if we take this number and multiply it by the 12 million square feet we will get a value of $960 million. Now taking into account the current total debt the company has which is $135 million, we will end up with a total value of $825 million dollars. Which is far above the current market cap of $347 million.

This valuation is without the other subsidiaries Reysas has, Mohnish stated in an earlier talk, that the solar business alone is worth $100 million +. This value will be added as icing on the cake along with all the other subsidiaries.

“Reysas trades at a steep discount to its liquidation value, and an even steeper discount to intrinsic value.” - Mohnish Pabrai 2023 “Free Lunch Portfolio”.

But how can a company which such amount of value be so undervalued?

The company has been trading at the same price for about 9 years from 2012 till 2019 (when Mohnish acquired 1/3 of the business). This is part due to the fact that the Turkish citizens have a different mindset when it comes to investing. They are more focussed on day trading and getting in and out of positions without having a view on long-term investing. Plus, foreign investors doesn’t seem to be so interested in investing in Turkey due to all the headwinds but, are these really headwinds? And does Reysas suffer from the inflation? There is always a chance that Mr, Market has it wrong if we dive deeper in to the company.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” - Benjamin Graham

Additional information

There are a lot of headwinds when it comes to investing in Turkey, one of them clearly is the huge inflation.

In 2018, for every dollar you exchanged, you got 3,81 TL back. Now 5 years later you will get 18,88 TL for every dollar you exchange. A huge increase of almost 400%. Which can cause foreign investors to pass on investing in Turkey.

But how does that apply to Reysas? Mohnish stated that. The assets of Reysas are automatically indexed with the inflation. Because a warehouse exists out of steel, concrete and land. All of these materials are going to move with inflation. Next to that, the rents are indexed as well because they also move with the inflation. Some of Reysas leases are in dollars or euros, and most of their debt is in TL.

Keep in mind that the inflation can to lower your rate of return and value of your investment if you are investing on the Borsa/Istanbul exchange.

In the process of researching this company I stumbled upon the fact that Reysas is extremely difficult to buy especially for EU investors. US investors have the ability to buy Reysas trough Fidelity but, keep in mind that there are high commission chargers (approx. $83 per ticket order) and you need to call them to place your order.

If you don’t have access to the Borsa/Istanbul stock exchange you can also buy Reysas on the OTC exchange.

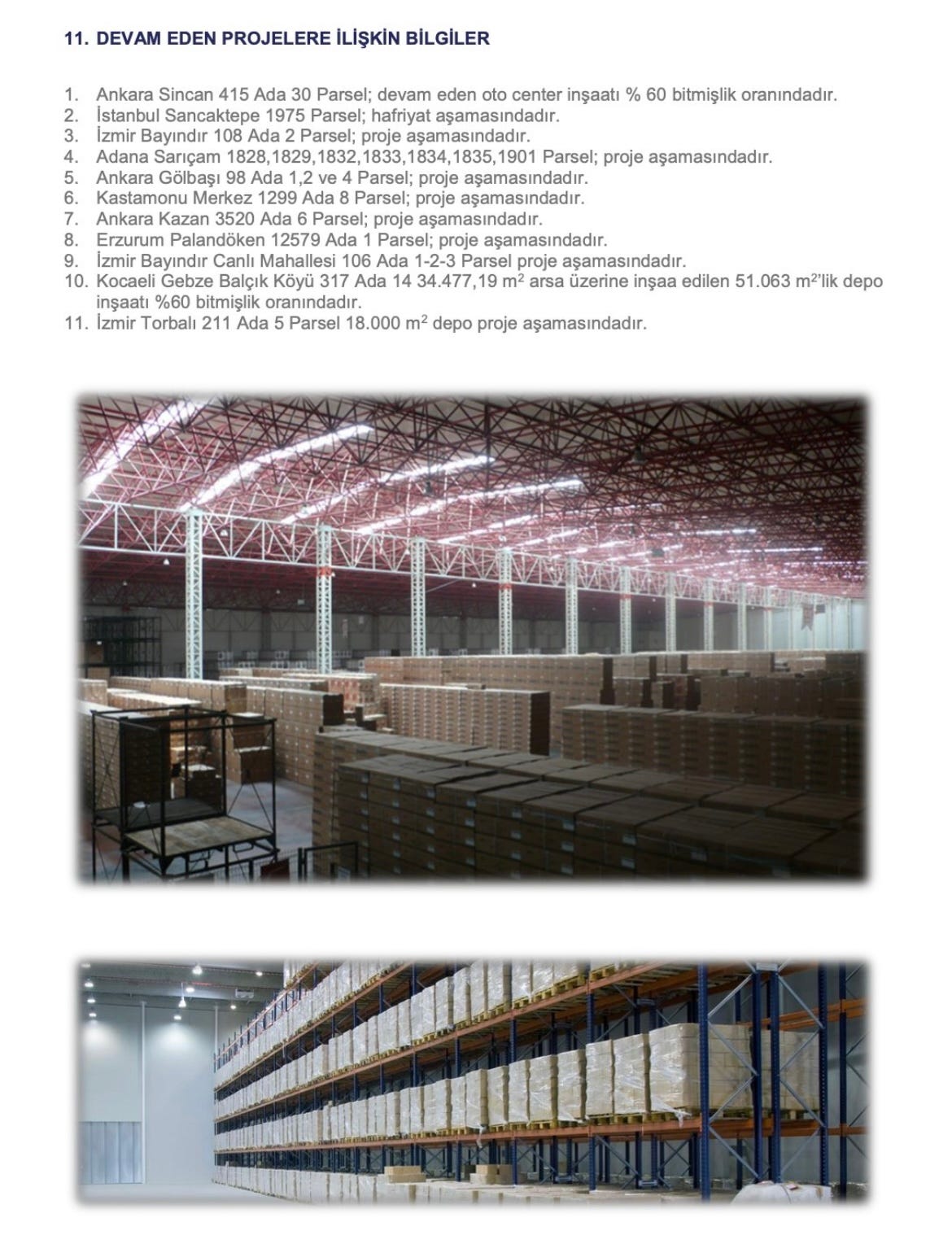

Despite the fact that Reysas is an asset play on the first sight, I do believe that the father and son are phenomenal capital allocators and that they have a long runway of compounding their capital. This is due to the fact that Reysas keeps building new warehouses. For example the not yet finished warehouse in Gebze, which will generate around 120-150 million TL and will be around 34.400 m2. And a warehouse in Izmir, which will be 18.000 m2. In total they have 11 ongoing projects for the coming years. Which will add more value to the business.

It is a hard business to crack, because we cannot fact-check everything Mohnish has said and trust him on his experience in the investing world but also with the management of Reysas. In a recent interview he stated that even when Reysas would go to a $1,5 billion market cap he wouldn’t sell. He knows the business and father & son so well and thinks he has the new Charlie Munger “Belridge Oil” company. While holding on to the company, he thinks 20 years from now Reysas would be worth $3 to $5 billion dollars.

In the end, there’s a lot that could go right with a company that is too undervalued to its market cap, but also some things that could go wrong since it remains a foreign country and we can’t fact-check everything. The future will tell us, and I will keep following Reysas.

We are watching paint dry. - Mohnish Pabrai

Thank you for taking your time to read this article. If you liked it please subscribe to my newsletter and join The Attic Archive Club!

I want to thank Mohnish Pabrai, Yiğit Aka and Yunus for delivering information about Reysas. All credits remain to them. This article is a summary based on the information they gave us.

Please don’t hesitate to comment on my write ups. Share your thoughts, ask a question or leave some feedback. This way we can build a community and expand the size of The Attic Archive Club.

Jarno,

founder The Attic Archive Club

Disclaimer: This article is for informational and educational purposes only. Anything written here is not financial advice and should not be seen as a buy or sell recommendation. Please do your own research or speak to a professional when it comes to investing. Valuations, prices, information and ratios may have changed since the time of this writing. At the time of writing this article I am a not a shareholder of RYSAS or RYSKF, nevertheless this article isn’t published to persuade you to buy or sell companies discussed here. I am not a financial advisor and I do not intend to be one. Articles written here are not buy or sell recommendations.

Thanks, it's my biggest position